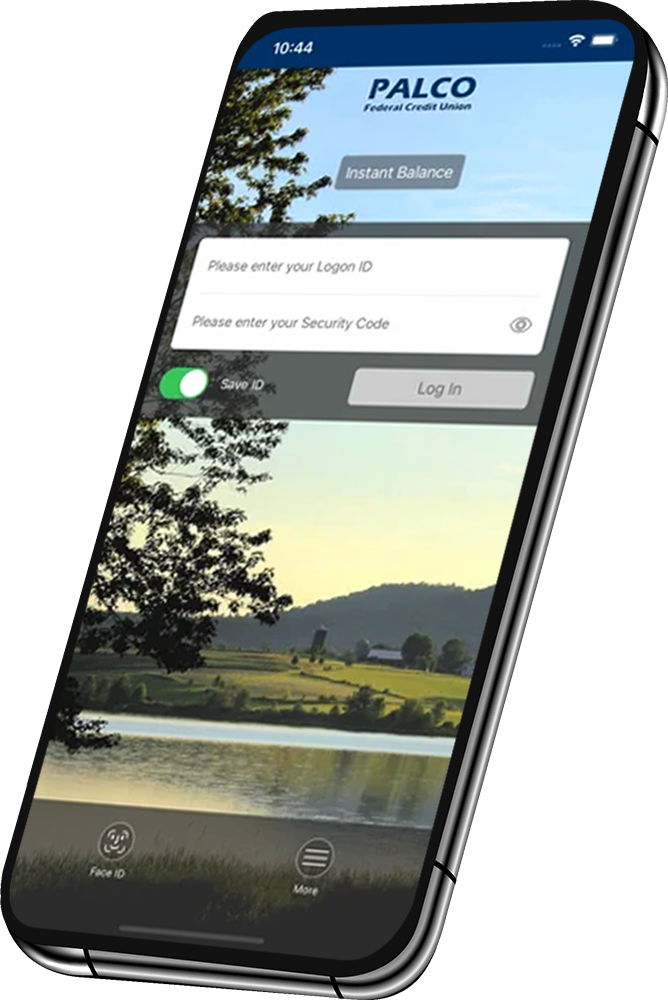

Download PALCO's Mobile App TODAY!

Life is unpredictable, and time is always short, but that shouldn’t stop you from banking when its convenient for you. With mobile banking, PALCO is always open, and its powerful features allow you to manage your money on your schedule. You can:

- View Account Balances

- Make Transfers

- Locate our Branch & ATMs

- View Transaction Details